Prepare to make

an offer in SC

Things to Mentally Prepare For Before Making An Offer

These recommendations will change based on the condition of the market, the property, the day of week, etc. This is intended to give you an outline of the negotiable/fill in the blank topics we’ll be discussing when it comes time to actually put in an offer.

1

Purchase Price

Think about the absolute MAX you are willing to pay for THAT specific property. This has nothing to do with what the Seller paid, what the Seller owes, or what the Seller is asking; it has everything to do with what the market says it is worth TODAY. What dollar amount will you be happy and content with, keeping in mind that another Buyer may be making an offer at the same time?

2

Due Diligence (DD) and Earnest Money (EMD)

a. Due Diligence:

This Fee is ONLY paid IF the contract is terminated. Based on market conditions, your Fee may need to be more or less competitive. For example, in a hot market your Fee may need to be higher, but can be lower if a property has been on the market for a while.

b. Earnest Money Deposit:

This is a deposit held in Escrow by the closing attorney and/ or title agent. This deposit can be refundable should you terminate because of specific listed contingencies within the contract such as an appraisal, sale, or wood destroying insect contingency. Should you move forward with the contract to close, this deposit is credited towards your total down payment/closing costs.

3

Inspection/Due Diligence Period

This is the period provided by the Seller to inspect the Property. The main difference between North and South Carolina is that you pay the due diligence fee in order to terminate in South Carolina vs. paying the due diligence fee upon contract acceptance in North Carolina. During this period your Earnest Money is protected in Escrow. Various inspections include but are not limited to radon, mechanical, structural, surveys, etc. We are talking $1,000+ for inspections and those are paid whether you close on the property or not. Not to scare you, we just want to be sure it’s a top contending property.

4

Closing Date

This date is typically 30-45 days from the initial date of contract, depending on the market conditions.

5

Personal Property

All appliances that are permanently attached to the property such as a dishwasher will stay as a fixture. Houses do not automatically include refrigerator, stove, washer or dryer and are considered personal property. Depending on market conditions, as well as the conditions of these specific appliances (refrigerator, washer, dryer, or stove), we may or may not ask for one, or all of them to be included in the sale.

6

Closing Costs

Closing costs and pre-paids (escrow, taxes, insurance) are additional expenses to consider. Please ask your lender what you can expect to pay here, as it varies by Buyer and purchase price. You can ask the Seller to pay a portion, or all of your closing costs, depending on market conditions, such as multiple offers, My recommendation will vary.

7

Home Warranty

Do you want the Seller to provide a 1-year (13-mo.) home warranty? Essentially it’s an insurance plan for your fixtures and appliances. You have the option of purchasing one on your own as well.

8

Additional Provisions

There may be other terms of the offer such as an expiration date, pre-negotiated repairs, potential appraisal contingencies, etc. This would all be dependent on the market and property conditions.

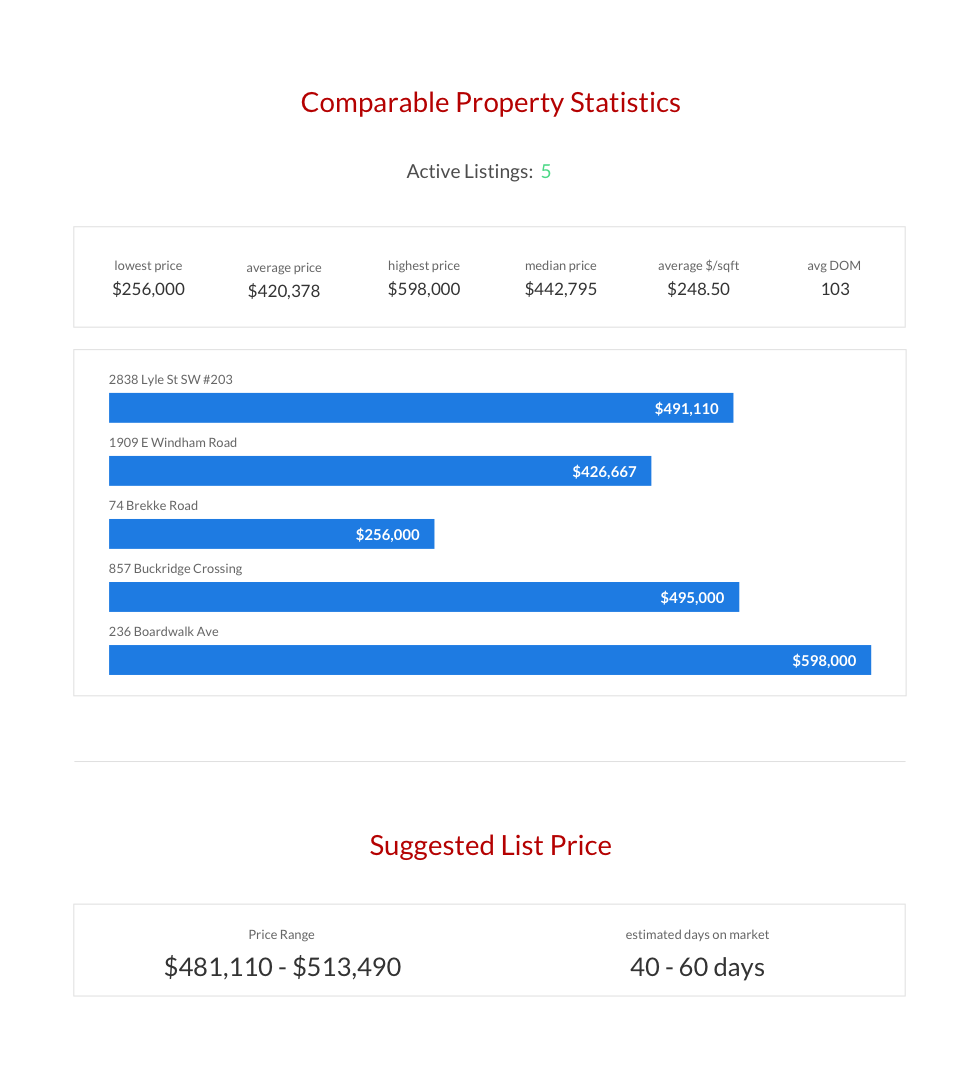

Our Pricing Strategy

Our real estate experts will use the most accurate method to price your home

The right price for your property is not determined by any agent or seller - it's determined by current market conditions. We plug into rich, up-to-date MLS data to select 5 active, 5 pending, and 5 sold properties that are comparable to your home. Combined with our in-depth knowledge of market statistics, this method assures we market your property correctly so that your listing sells when you want for the price you deserve.

See your instant home value now for free

See Your Home Value