More Choice in

Mortgage Solutions

Our mortgage loan originators help you find the right mortgage for your unique needs. Contact us to learn more about our programs!

Unlock your dream

home today.

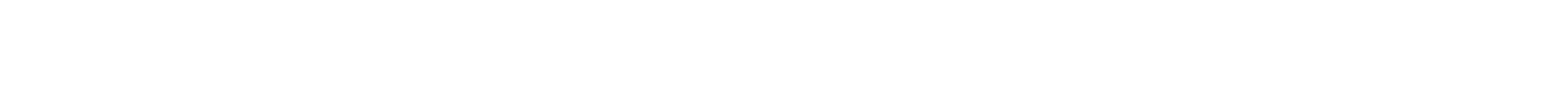

Say goodbye to the uncertainty of contingent offers, and buy before you sell.

$2,000 cash guarantee for

on time close.

Our pre-approvals are fully underwritten, so you can be confident we will close on time.

Refinance at little to no cost, on your timeline.

Ask us about our competitive refinancing options so we can find the best solution for you.

NMLS #6666